COMMERCIAL FINANCE

HOW WE CAN HELP

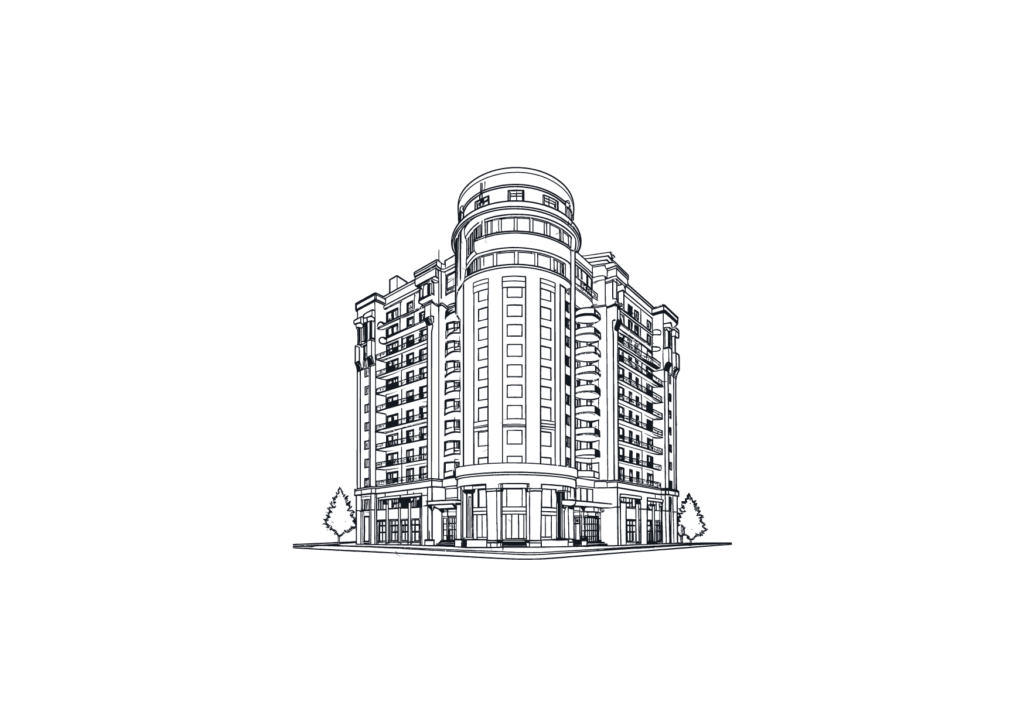

Commercial Investment Finance London

Commercial Investment Finance is geared towards investors purchasing commercial properties that are rented / or will be rented to a commercial tenant and generating a yield.

This market space is highly complex and many factors affect the lending, such as, the covenant (tenant) paying the rent, the location, your experience as a commercial investor, The location of the property, the terms of the lease between the landlord and tenant, the rent payable.

We specialise in this field of lending. We know what the Banks are looking for. Our advisors have worked for some of the High Street Banks in commercial and business banking, which helps them understand and structure your finance.

Commercial Mortgages

A Commercial Mortgage is lending against your businesses trading premises.

Understanding how your business operates is essential in securing the right type of lending for you.

Lenders will be looking at your Accounts (in particular your turnover, gross profits and net profits), your business account conduct, where you are located, your market and industry, your experience and of course how much deposit/equity you have.

Our initial conversation will be to get a feel for what you are trying to achieve. From this your advisor will create a plan and request all the documents required to structure your lending.

Having specialist advisors in the arena should give you the peace of mind to know if this type of funding is suitable, we can achieve it for you.

Business Finance London

As business owners ourselves we understand being liquid is vital. specialist brokers we aim to provide business owners with cash to grow their business.

They almost all have no relationship for their bank and don’t have dependable advice and assistance which they can trust. We focus our business finance experts on getting the funding so that s clients can focus on doing what matters – growing their. We provide commercial finance brokers to support London business. We pride ourselves on supporting the London industry by providing services. We are devoted to our clients who get access to the cash they need for growth of the business enterprise.

Other forms of commercial finance:

Invoice Financing

Invoice financing is becoming extremely popular, whereby a lender allows your business to leverage a loan facility against outstanding invoices. This form of finance is considered as quick and short-term lending.

A simple example may be that you may have salaries and staff wages to pay and are waiting for an invoice to be settled and need liquid cash. This form of lending allows you this facility and it is paid back once the invoice has been settled.

To discuss your requirements in the strictest confidence please get in touch using the below form.

Asset Finance

A particular arena geared mainly towards individuals who want to borrow money against assets such as Luxury Cars, Vintage Cars, Art, Jewellery and Luxury Watches, Sports & Entertainment Contracts, Designer Handbags to name a few.

By utilising these assets you could access the equity in these high equity, low liquidity items to raise capital for other uses. These funds can be used as a short-term loan or an ongoing credit line (for this option the interest will need to be serviced for the loan on an agreed rate).

The lending is solely against the asset and stored by the lender in their vaults until paid back.

To discuss your requirements in the strictest confidence please get in touch using the below form.

Our Autumn 2024 Budget Breakdown

Autumn Budget 2024: Key Tax Changes and Their Implications for the Real Estate

Navigating Commercial Investment Finance: A Comprehensive Guide to Buying Commercial Property in the UK

Investing in commercial property can be a rewarding venture, offering potential for substantial