The property market in 2024 is presenting unique opportunities for high net worth individuals to optimise their investment returns. Despite rising house prices, falling mortgage rates offer a window of opportunity for those adopting creative strategies. In this article, we’ll explore three innovative investment approaches that can help investors unlock value in the current market, backed by real data.

Strategy 1: Diversified Buy-to-Let (BTL) Portfolios

Diversification remains one of the most effective ways to manage risk while maximising returns in property investment. A well-structured BTL portfolio, spread across different asset classes and regions, is more resilient to market fluctuations.

Asset Diversification: According to data from UK Finance, residential Buy-to-Let mortgages saw a 12% increase in 2023, reflecting ongoing confidence in this sector. However, there has also been a 7% uptick in lending for mixed-use properties, signalling growing interest in commercial-residential combinations. This trend is expected to continue into 2024 as investors seek higher yields and more balanced portfolios.

Regional Variations: Recent data from Zoopla shows that property prices in up-and-coming areas such as Manchester and Birmingham have risen by 9% and 7%, respectively, in the past year. Conversely, “blue chip” areas like London have seen slower growth but continue to offer stable rental income with an average yield of 4.1%. By balancing investments between these regions, investors can benefit from both growth potential and steady cash flow.

Here’s a visual comparison of property price growth in emerging versus established areas:

Strategy 2: Co-Living Spaces

Co-living has become one of the fastest-growing trends in the property market, driven by demand from young professionals seeking affordable, flexible housing solutions. As this trend accelerates, investors can tap into a lucrative market segment by focusing on co-living developments.

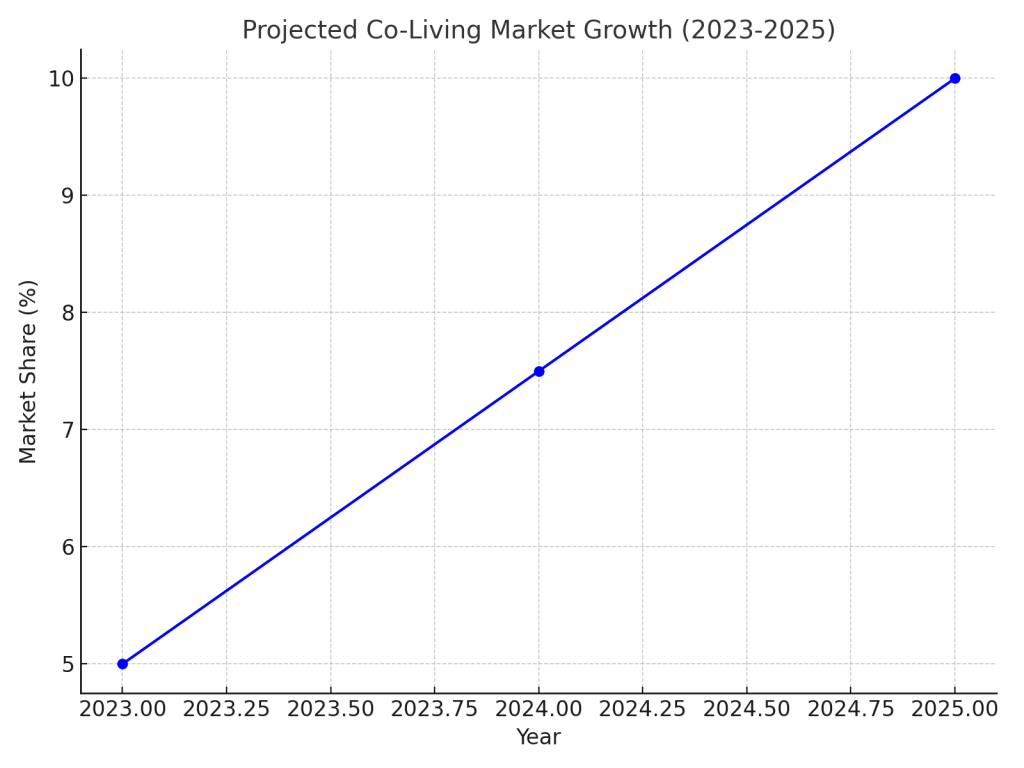

Meeting Demand: A recent study by JLL estimates that co-living spaces could represent up to 10% of the rental market by 2025. This surge in demand is driven by affordability concerns—especially in major cities like London, where the average rent for a one-bedroom flat has now surpassed £2,000 per month.

Higher Yields: Data from Knight Frank shows that co-living properties can generate up to 20% higher rental yields compared to traditional BTL properties. By leasing out individual rooms and providing shared facilities, investors are able to capitalise on the rising demand for affordable and sociable living environments.

Below is a chart illustrating the projected growth of the co-living sector through 2024:

Strategy 3: Green Investments

Sustainability is becoming a core consideration for both investors and tenants. Eco-friendly properties not only appeal to environmentally conscious renters but also offer long-term financial benefits, especially in terms of reduced energy costs.

Rising Demand for Green Homes: A recent survey by Savills found that 75% of renters would be willing to pay a premium for an energy-efficient home. Furthermore, as energy prices continue to climb—electricity prices in the UK increased by 17% in 2023 alone—homes with eco-friendly features like solar panels and efficient insulation become even more attractive.

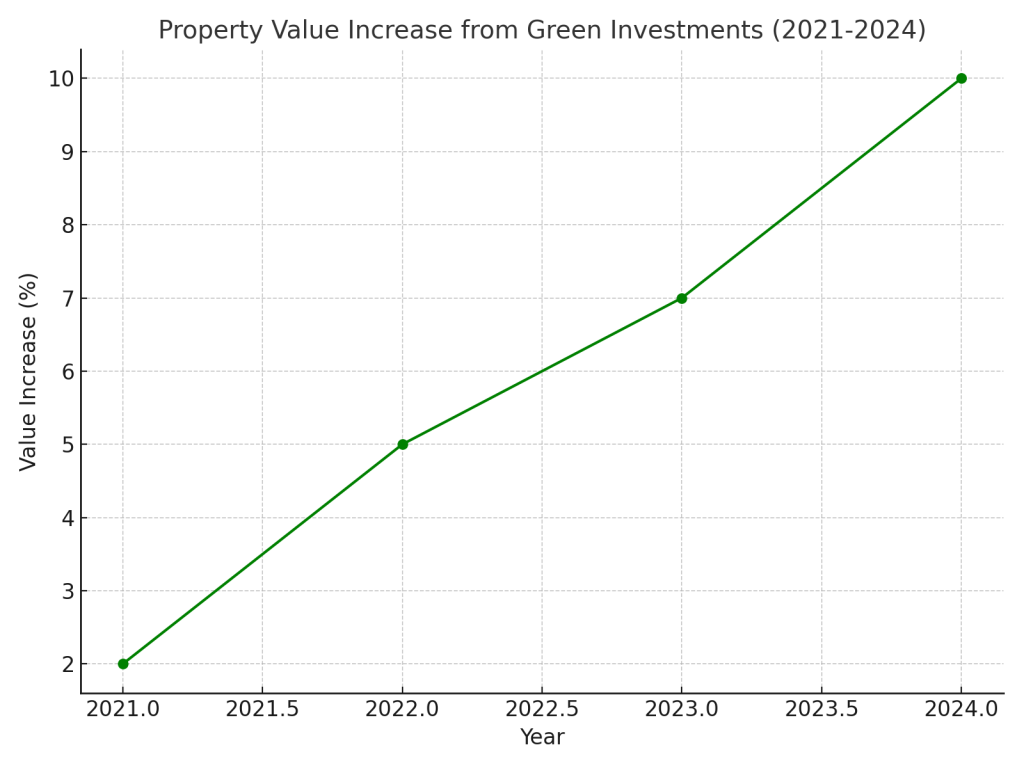

Government Incentives: Investors can take advantage of various government schemes aimed at promoting green investments. The Green Homes Grant, for example, offers substantial financial support for property owners looking to make energy efficiency upgrades, which can also increase property value by up to 10%, according to the Energy Saving Trust.

The chart below shows the rising trend of green property investment in the UK:

Conclusion

In 2024, innovative investment strategies are essential for navigating the evolving property market. Diversifying BTL portfolios, investing in the growing co-living sector, and focusing on eco-friendly properties can help investors not only maximise returns but also future-proof their portfolios against emerging trends.

At London FS, we provide tailored advice to help investors capitalise on these opportunities. Whether you’re looking to expand your portfolio, explore new asset types, or invest in green properties, our expert team is here to guide you through the process.

For more information, get in touch with one of our specialists today!